What is double-entry accounting banzai – Embark on an illuminating journey into the realm of double-entry accounting, the bedrock of financial reporting and the key to unlocking the secrets of sound business management. This comprehensive guide will delve into the intricacies of this accounting method, empowering you with the knowledge and skills to navigate the complexities of financial transactions and achieve financial success.

Double-entry accounting, a time-honored practice, has stood the test of time as the cornerstone of accurate and reliable financial reporting. Its systematic approach ensures the integrity of financial records, providing a clear and comprehensive picture of an organization’s financial health.

1. Double-Entry Accounting Overview

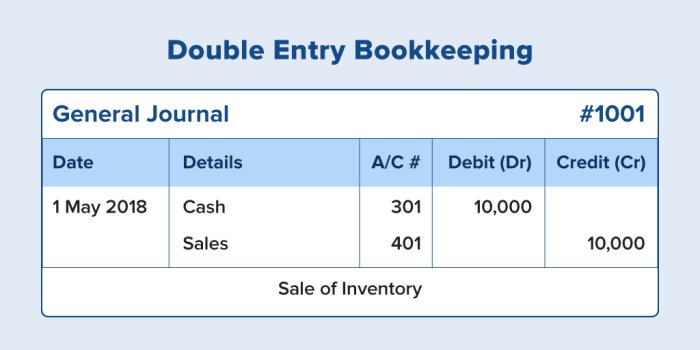

Double-entry accounting is a system of recording financial transactions in which each transaction is recorded in at least two separate accounts. This system ensures that the total debits always equal the total credits, which helps to maintain the accuracy and integrity of the financial records.

For example, when a company purchases inventory, the debit is recorded in the Inventory account and the credit is recorded in the Accounts Payable account. This ensures that the total value of the inventory is recorded, and that the company’s liability to the supplier is also recorded.

Benefits of Double-Entry Accounting

- Accuracy: Double-entry accounting helps to ensure the accuracy of financial records by requiring that each transaction be recorded in at least two separate accounts.

- Completeness: Double-entry accounting helps to ensure that all financial transactions are recorded, as each transaction must be recorded in at least two separate accounts.

- Timeliness: Double-entry accounting helps to ensure that financial transactions are recorded in a timely manner, as each transaction must be recorded in at least two separate accounts.

2. Double-Entry Accounting System

Components of a Double-Entry Accounting System, What is double-entry accounting banzai

- Chart of Accounts:A chart of accounts is a list of all the accounts used in a double-entry accounting system.

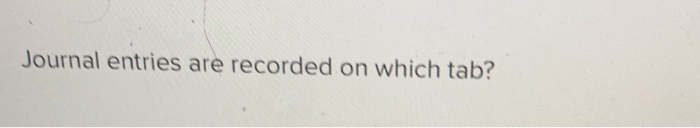

- Journal:A journal is a chronological record of all financial transactions.

- Ledger:A ledger is a collection of accounts that are used to track the balances of each account.

- Trial Balance:A trial balance is a report that lists all of the accounts in a chart of accounts and their balances.

- Financial Statements:Financial statements are reports that summarize the financial performance of a company.

3. Double-Entry Accounting Methods: What Is Double-entry Accounting Banzai

Cash Basis Accounting

Cash basis accounting is a method of accounting in which revenue is recorded when cash is received and expenses are recorded when cash is paid.

Accrual Basis Accounting

Accrual basis accounting is a method of accounting in which revenue is recorded when it is earned and expenses are recorded when they are incurred.

Advantages and Disadvantages of Double-Entry Accounting Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| Cash Basis Accounting |

|

|

| Accrual Basis Accounting |

|

|

4. Double-Entry Accounting Software

Benefits of Double-Entry Accounting Software

- Accuracy: Double-entry accounting software helps to ensure the accuracy of financial records by automating the recording of transactions.

- Efficiency: Double-entry accounting software helps to improve efficiency by automating the recording of transactions and generating reports.

- Compliance: Double-entry accounting software helps to ensure compliance with GAAP and other accounting standards.

Comparison of Double-Entry Accounting Software Options

| Software | Features | Benefits |

|---|---|---|

| QuickBooks |

|

|

| Sage Intacct |

|

|

| NetSuite |

|

|

5. Double-Entry Accounting Standards

International Financial Reporting Standards (IFRS)

IFRS are a set of accounting standards that are used by companies in over 140 countries around the world.

Generally Accepted Accounting Principles (GAAP)

GAAP are a set of accounting standards that are used by companies in the United States.

Importance of Adhering to Double-Entry Accounting Standards

- Accuracy: Adhering to double-entry accounting standards helps to ensure the accuracy of financial records.

- Consistency: Adhering to double-entry accounting standards helps to ensure that financial records are consistent from period to period.

- Transparency: Adhering to double-entry accounting standards helps to ensure that financial records are transparent and easy to understand.

Answers to Common Questions

What are the fundamental principles of double-entry accounting?

Double-entry accounting is based on the principle that every transaction has two aspects, a debit, and a credit, which are recorded in separate accounts. The sum of debits must always equal the sum of credits, ensuring the accounting equation remains in balance.

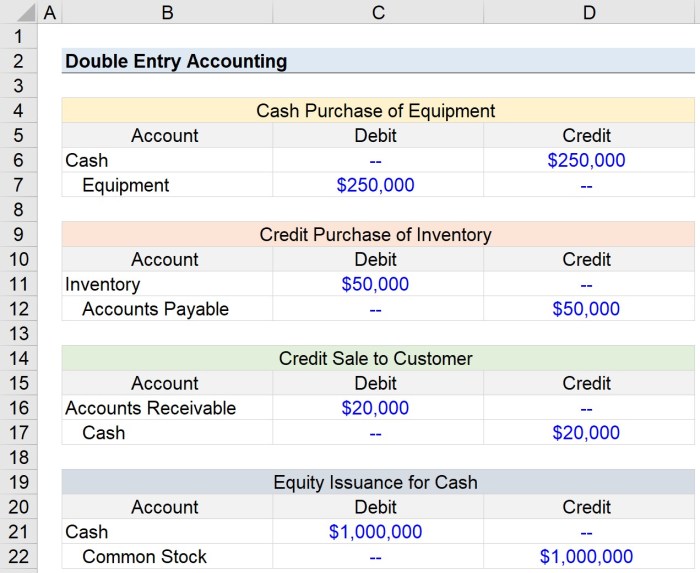

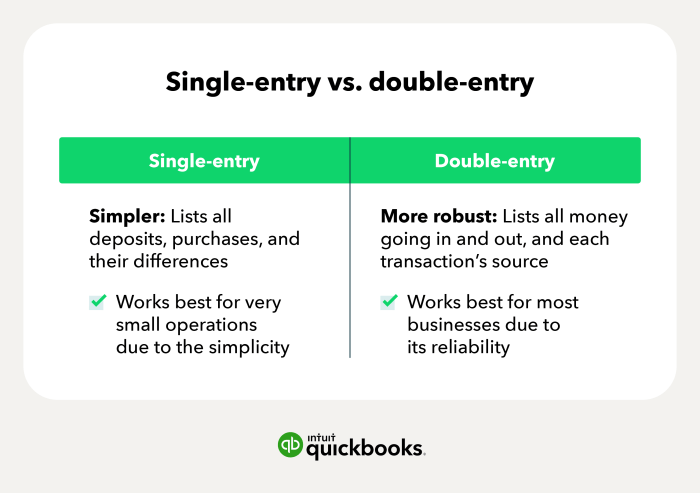

How does double-entry accounting differ from single-entry accounting?

Single-entry accounting records only the inflow and outflow of cash, while double-entry accounting provides a more comprehensive view by recording both the source and destination of each transaction. This enhanced level of detail facilitates accurate financial reporting and analysis.

What are the benefits of using double-entry accounting software?

Double-entry accounting software automates many of the tasks involved in the accounting process, saving time and reducing the risk of errors. It also provides real-time access to financial data, enabling businesses to make informed decisions promptly.